When exploring the nuances between Trip Insurance and Travel Insurance, travelers are often faced with choices that can significantly impact their journeys. This guide delves into the distinct features of each type of insurance, shedding light on when one may be more suitable than the other.

Whether you're planning a quick getaway or a long-term adventure, understanding these key differences is essential for safeguarding your travel experience.

Trip Insurance vs Travel Insurance

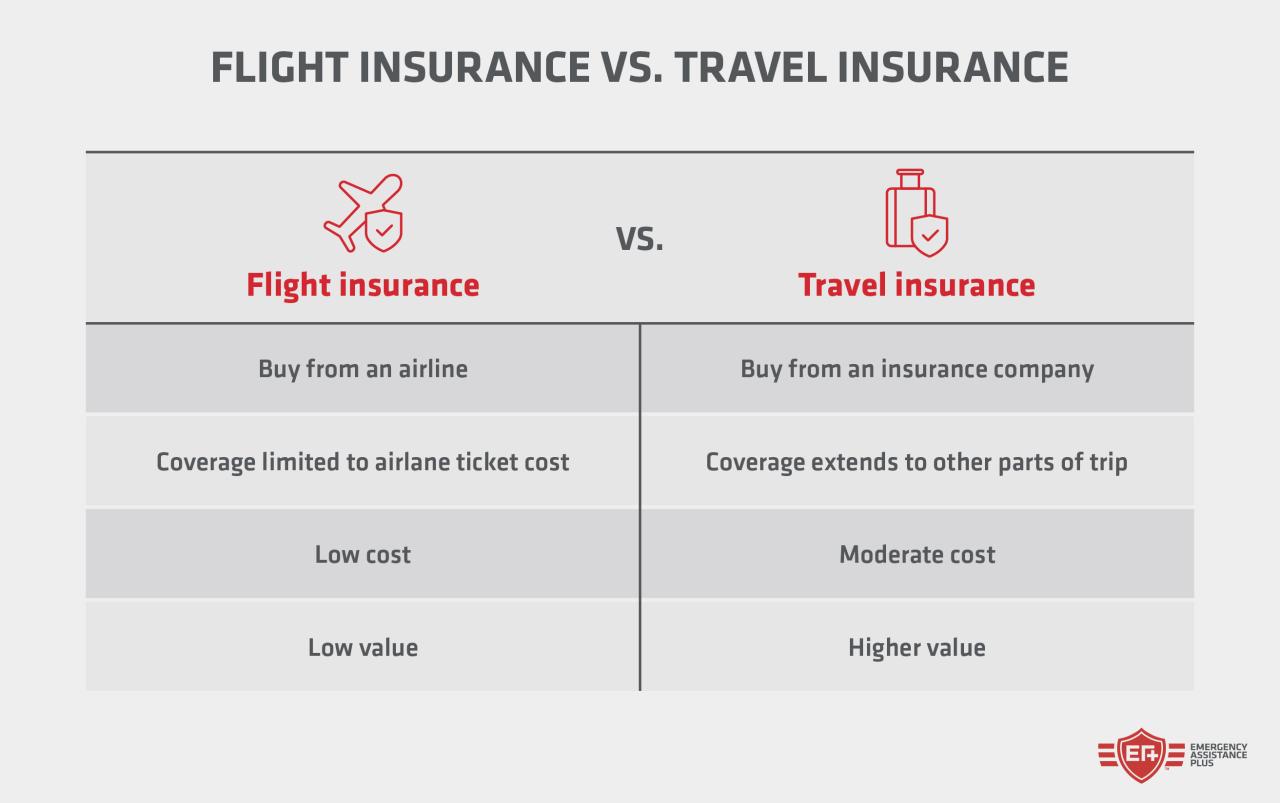

When it comes to planning for a trip, understanding the differences between trip insurance and travel insurance is crucial. While both types of insurance offer protection for travelers, there are distinct variations in coverage and suitability for different situations.Trip insurance typically covers specific trips, providing protection for cancellations, delays, or interruptions that may occur.

This type of insurance is ideal for travelers who have planned a single trip and want coverage for unexpected events that may disrupt their travel plans.

Trip Insurance: Example Scenarios

- John books a week-long cruise to the Caribbean but has to cancel at the last minute due to a family emergency. Trip insurance would likely cover the cost of the cruise and any associated expenses.

- Sarah's flight to Europe is delayed, causing her to miss her connecting flight and hotel reservation. Trip insurance could help reimburse her for the additional costs incurred due to the delay.

Travel Insurance: Example Scenarios

- Emma is a frequent traveler who embarks on multiple trips throughout the year. Travel insurance would provide coverage for all her trips within a specified period, offering comprehensive protection for various unforeseen circumstances.

- Michael is planning a backpacking trip around Southeast Asia, visiting multiple countries over several months. Travel insurance would be more suitable for his extended journey, providing coverage for medical emergencies, trip cancellations, and other travel-related risks.

Coverage and Benefits

When it comes to trip insurance and travel insurance, understanding the coverage and benefits offered by each can help travelers make informed decisions to protect themselves during their journeys.

Types of Coverage Offered by Trip Insurance

Trip insurance typically provides coverage for trip cancellations, interruptions, and delays, as well as emergency medical expenses during the trip. It may also cover lost or delayed baggage, rental car damage, and emergency evacuation. Some trip insurance plans also include coverage for pre-existing medical conditions, which can be crucial for travelers with underlying health issues.

Benefits Provided by Travel Insurance Plans

Travel insurance plans offer a wider range of benefits compared to trip insurance. In addition to trip cancellation and interruption coverage, travel insurance often includes emergency medical coverage, trip delay reimbursement, baggage loss or delay coverage, and 24/7 travel assistance services.

Travel insurance plans may also provide coverage for adventure activities, sports injuries, and natural disasters at the travel destination.

Comparison of Coverage Limitations

While trip insurance is more focused on covering specific incidents related to the trip itself, such as cancellations or medical emergencies during the trip, travel insurance offers a more comprehensive set of benefits that extend beyond the trip. Travel insurance usually has higher coverage limits for emergency medical expenses, trip cancellations, and baggage losses compared to trip insurance.

Additionally, travel insurance may cover a wider range of scenarios, making it a more versatile option for travelers who want extra protection during their journeys.

Cost and Premiums

When it comes to trip and travel insurance, understanding the cost and premiums involved is essential for travelers to make informed decisions. Let's take a closer look at how these costs are calculated and what factors influence the premiums.

Cost of Trip Insurance

Trip insurance costs are typically calculated based on a percentage of the total trip cost. This percentage can vary depending on the insurance provider and the level of coverage chosen by the traveler. For example, a basic trip insurance policy may cost around 4-10% of the total trip cost, while a more comprehensive policy with additional coverage options could cost 12% or more.

Factors Influencing Travel Insurance Premiums

Several factors can influence the premiums of travel insurance. These factors may include the traveler's age, destination, trip duration, coverage limits, and any optional add-ons selected. For instance, older travelers may be charged higher premiums due to an increased risk of health issues during the trip, while travelers visiting high-risk destinations may also face higher premiums.

- The traveler's age: Older travelers may have to pay higher premiums due to increased health risks.

- Destination: Traveling to high-risk destinations can lead to higher premiums.

- Trip duration: Longer trips may result in higher premiums as there is a higher chance of incidents occurring over an extended period.

- Coverage limits: Opting for higher coverage limits can lead to increased premiums.

- Optional add-ons: Choosing additional coverage options like adventure sports coverage or cancel for any reason coverage can also impact premiums.

Tips to Save Money on Trip or Travel Insurance

- Compare quotes from multiple insurance providers to find the best price for the coverage you need.

- Consider opting for a plan with basic coverage if you don't require extensive benefits to save on premiums.

- Book your insurance early to take advantage of lower rates and avoid last-minute price hikes.

- Avoid unnecessary add-ons and choose only the coverage options that are essential for your trip.

- Look for discounts or promotional offers that may be available through certain providers or affiliations.

Claim Process and Customer Support

When it comes to trip insurance and travel insurance, understanding the claim process and customer support services can make a significant difference in your overall experience. Let's explore the key differences in this area.

Claim Process for Trip Insurance Claims

- When filing a claim for trip insurance, travelers typically need to provide documentation such as proof of trip cancellation, medical reports (if applicable), receipts for expenses incurred, and any other relevant paperwork.

- Claims are usually submitted directly to the insurance provider, either online or through a designated claims department.

- After the claim is submitted, the insurance company will review the documentation provided and assess the validity of the claim before processing any payments.

- The claim process for trip insurance can vary depending on the provider and the specific policy purchased, so it's essential to carefully read through the terms and conditions to understand what is required.

Customer Support Services for Travel Insurance

- Travel insurance providers often offer customer support services to assist travelers with any questions or concerns they may have before, during, or after their trip.

- Customer support services can include a 24/7 helpline, online chat support, email correspondence, and in some cases, assistance in multiple languages for international travelers.

- Having access to reliable customer support can help travelers navigate the claims process more effectively and address any issues that may arise while traveling.

Efficiency of Claim Processing Between Trip Insurance and Travel Insurance Providers

- Travel insurance providers are known for their efficient claim processing, often providing quick responses and timely payments to travelers in need.

- On the other hand, trip insurance claims may take longer to process, especially if extensive documentation is required or if there are any discrepancies in the information provided.

- While both trip insurance and travel insurance providers aim to settle claims promptly, the efficiency of claim processing can vary based on the provider's internal procedures and workload.

Ending Remarks

As we conclude our exploration of Trip Insurance vs Travel Insurance: Key Differences, it becomes evident that making an informed decision about your insurance needs can make all the difference in ensuring a smooth and stress-free travel experience. By grasping the unique advantages offered by each type of insurance, travelers can embark on their journeys with confidence and peace of mind.

FAQ Explained

What is the main difference between Trip Insurance and Travel Insurance?

While Trip Insurance typically covers specific trips, Travel Insurance offers broader coverage for various travel-related issues beyond individual trips.

When should I opt for Trip Insurance instead of Travel Insurance?

Trip Insurance is more suitable for short, specific trips where coverage for cancellations or interruptions is the primary concern.

How are the premiums calculated for Travel Insurance?

The premiums for Travel Insurance are influenced by factors like age, destination, length of travel, and coverage options chosen.

What types of coverage are typically offered by Trip Insurance?

Trip Insurance often covers trip cancellations, delays, lost baggage, medical emergencies, and other related issues specific to individual trips.

How efficient is the claim processing for Trip Insurance compared to Travel Insurance?

Claim processing for Trip Insurance can vary but is generally quicker and more straightforward compared to Travel Insurance due to the limited scope of coverage.

![Best Seniors Travel Insurance Over 65 Quotes [Compare Rates]](https://travel.fin.co.id/wp-content/uploads/2025/12/Senior-Travel-Insurance-Help-Us-1024x576-1-120x86.png)